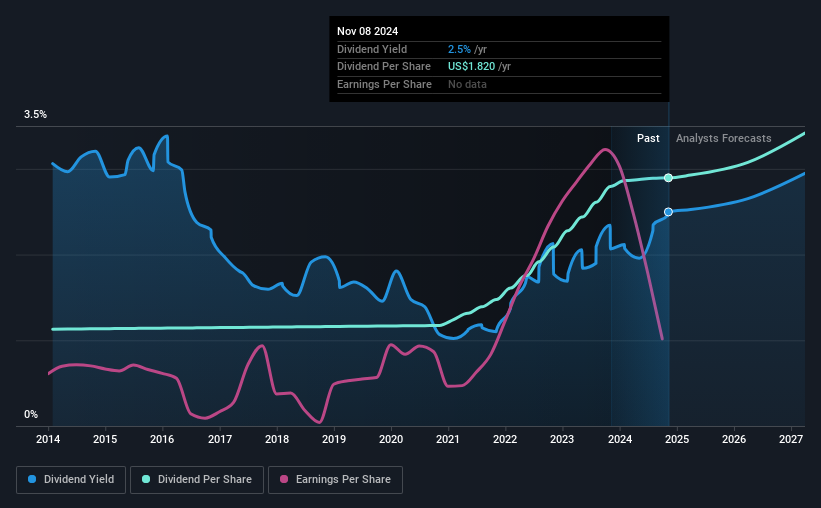

Microchip Technology Incorporated (NASDAQ:MCHP) announced that it will increase its dividend from last year’s comparable payout on December 6th to $0.455. This will take the annual payment to 2.5% of the purchase price, which is above what most companies in the industry pay.

Check out our latest review for Microchip Technology

Microchip Technology Pay may have a solid Reward

If the payments don’t last, a few years of high yields won’t matter much. Before making this announcement, Microchip Technology’s dividend was higher than its profit, but free cash flow more than covered it. In general, we think that cash is more important than profit accounting methods, so with cash flow easily covering the dividend, we don’t think there is much cause for concern.

Next year is set to see EPS grow by 150.8%. Under the assumption that profits will continue to follow current trends, we think that the payout ratio will be around 54% which would be easy to drive profits forward.

Microchip technology has a solid track record

The company has an extended history of paying consistent dividends. The dividend has gone from an average annual dividend of $0.71 in 2014 to a recent annual dividend of $1.82. This means that the company grew its dividend at an annual rate of about 9.9% during that period. The share has been growing very well for several years, and has given its owners good income in their portfolios.

Growth Dividends Can Be Disruptive

Some investors will be looking to buy a company’s stock based on its dividend history. It is encouraging to see that Microchip Technology has been growing its earnings per share by 13% per year for the past five years. Even if earnings per share are growing at a reliable rate, a large payout ratio can limit the growth of the company’s future payouts.

Our thoughts on the Microchip Technology division

In general, we always like to see earnings increase, but we don’t think Microchip Technology will make much money. The company generates a lot of cash, but we still think the dividend is a bit high for comfort. We don’t think Microchip Technology is a good stock to add to your portfolio if you’re focused on capital.

Companies with a consistent dividend policy are likely to enjoy greater investor interest than those with an inconsistent pattern. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should be aware of when evaluating a company. For example, we chose 3 warning signs for Microchip Technology which investors should be aware of. Looking for more high profit ideas? Try us A collection of strong dividend payers.

New: Manage all your stock portfolios in one place

We made the ultimate portfolio partner for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Alerting of New Warning Signs or Hazards by email or phone

• Track the Quality of your goods

Try Demo Portfolio for free

Have a comment about this article? Are you concerned about the news? Get together and us directly. Alternatively, email the editors (at) simplywallst.com.

This Simply Wall St article is general in nature. We provide commentary based on historical data and analyst estimates using an unbiased approach and our articles are not intended as financial advice. It does not make an offer to buy or sell any property, and does not consider your motives, or your financial situation. We are committed to bringing you long-term analysis focused on fundamentals. Note that our review may not cover recent releases that are not sensitive to pricing or quality materials. Simply Wall St has no position in the stocks mentioned.

#Microchip #Technology #NASDAQMCHP #pay #larger #tax #year